Payroll calculator easy tax

Get Started With ADP Payroll. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

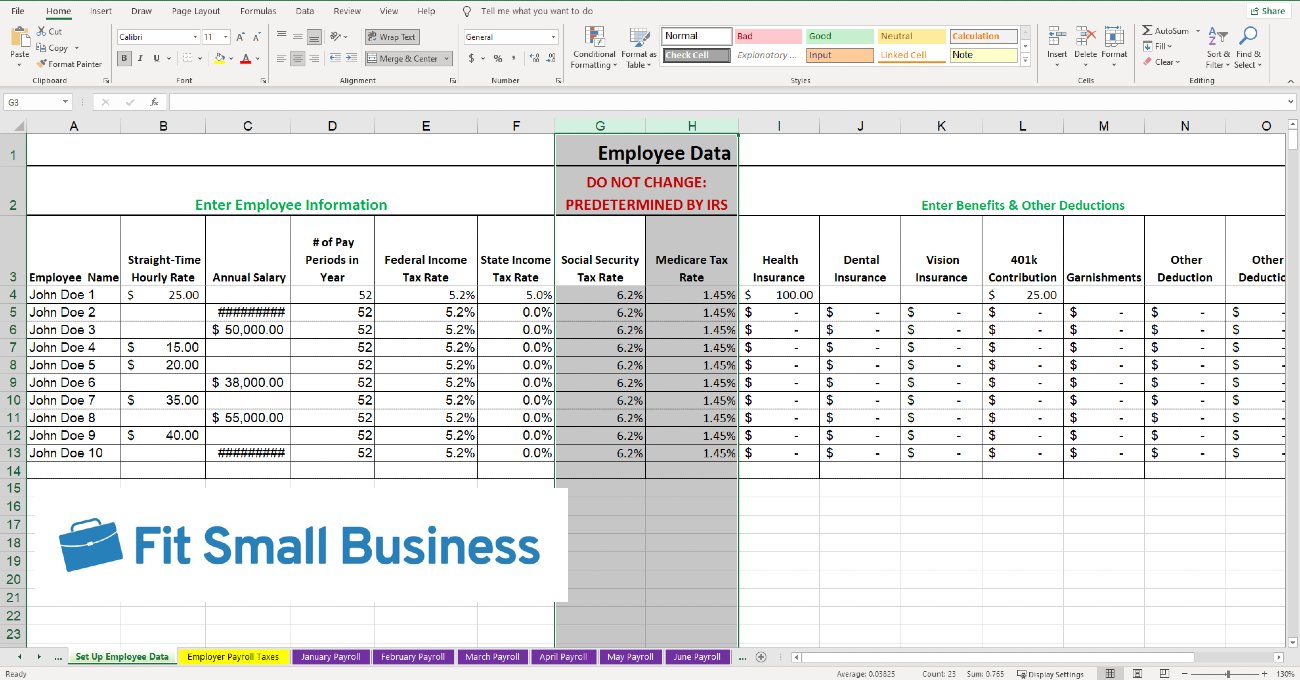

How To Do Payroll In Excel In 7 Steps Free Template

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

. Switch to Minnesota salary calculator. If its time to pay your employees youre in the right place. The 2022 Weekly Pay Tax Calculator calculates your take home pay based on your Weekly Salary.

Ad Payroll Software 2022 - Easy Fast Efficient and Reliable. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Well run your payroll for up to 40 less.

Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. Ad Designed for small business ezPaycheck is easy-to-use and flexible. Our updated and free online salary tax calculator incorporates the changes announced in the Budget Speech.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. All Services Backed by Tax Guarantee. View what your tax saving or liability will be in the 20222023 tax year.

Free Unbiased Reviews Top Picks. Keep your finances organized and compliant with government regulations. If you have a job you receive your salary through the monthly bi-weekly or.

Ad Learn How Heartland is Powering Americas Small Business Renaissance. For employers and employees - Use the calculator to determine the correct withholding amount for either Vehicle Registration. Supports hourly salary income and multiple pay frequencies.

Get your payroll done right every time. Calculate VRC and COD Garnishment Amount. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Over 900000 Businesses Utilize Our Fast Easy Payroll. An income tax calculator is an online tool that lets you calculate your income tax liability based on the income generated in. Fast easy accurate payroll and tax so you save time and money.

Ad Run your business. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. But calculating your weekly take-home.

Ad Process Payroll Faster Easier With ADP Payroll. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Well run your payroll for up to 40 less.

Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. Whether its W-4 deductions gross-up or. This calculator is always up to date and conforms to official Australian Tax Office.

To calculate the payroll tax youll need to apply to your employees wages follow these simple instructions and youll have a quick estimate of the true cost of each employee on your payroll. For example if you earn 2000week your annual income is calculated by. Choose Tax Year and State Tax Year for Federal W-4 Information Filing Status Children under Age 17 qualify for child tax credit Other Dependents Check if you.

This free easy to use payroll calculator will calculate your take home pay. Discover ADP Payroll Benefits Insurance Time Talent HR More. A Service that you can trust.

Heres a step-by-step guide to walk you. Small Business Payroll 1-49 Employees. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Get Started With ADP Payroll. Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business. Employers can use it to calculate net pay and figure out how much to withhold so you can be confident about your employees paych See more.

Ad Payroll So Easy You Can Set It Up Run It Yourself. This federal hourly paycheck. Pay calculator Use this calculator to quickly estimate how much tax you will need to pay on your income.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Using The Hourly Wage Tax Calculator. How Your Paycheck Works.

Computes federal and state tax withholding for. Payroll calculator tools to help with. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

8 FREE payroll calculators for you and your employees If youre looking to calculate payroll for an employee or yourself youve come to the right place. Canadian Payroll Calculator the easiest way to calculate your payroll taxes and estimate your after-tax salary. Ad Compare This Years Top 5 Free Payroll Software.

Big on service small on fees. Ad Process Payroll Faster Easier With ADP Payroll. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Net Pay Step By Step Example

Net To Gross Calculator

How To Calculate Federal Income Tax

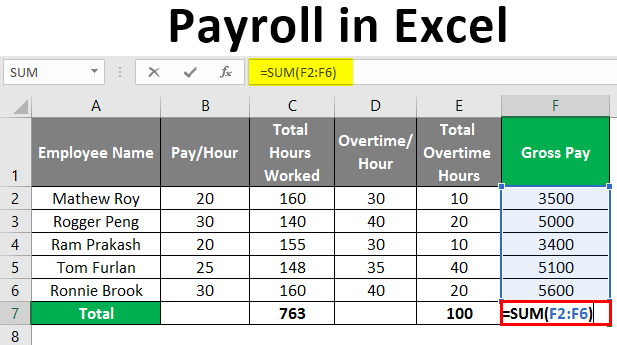

Payroll In Excel How To Create Payroll In Excel With Steps

Payroll Formula Step By Step Calculation With Examples

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Payroll Taxes Methods Examples More

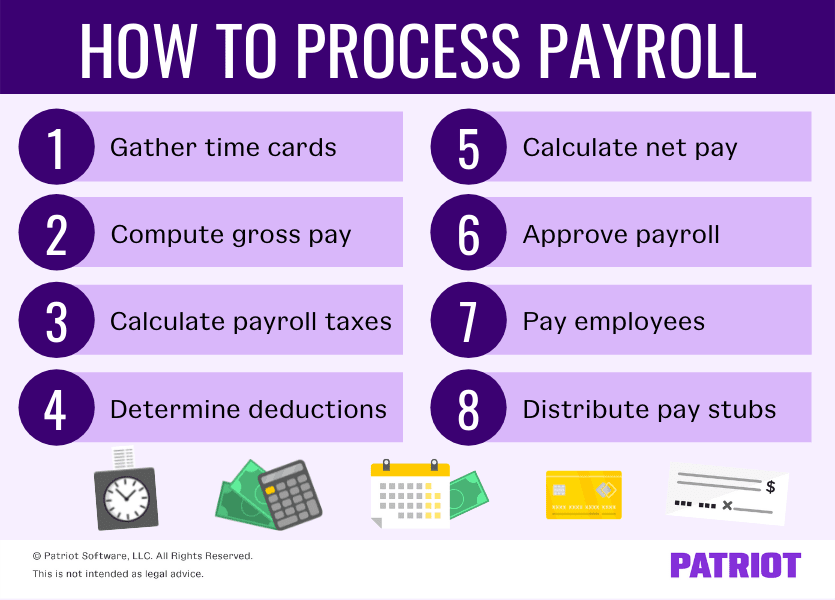

How To Process Payroll For Employees In 8 Straightforward Steps

Payroll Formula Step By Step Calculation With Examples